Post written by Chuck Braxton, REALTOR®, Roche Realty Group, Inc.

Just as a tree in the forest does not grow to the clouds, the value of an undeveloped lot in a residential subdivision does not rise indefinitely. Owners of vacant lots face a challenge–How long to hold this type of property?

This question is particularly important here in the Lakes Region of New Hampshire where a number of subdivisions begun 20-35 years ago combine amenities for second home owners such as beach rights or lake and mountain views with basic sites suitable for seasonal and year-round homes. These subdivisions have developed more slowly and, despite an increased interest in buildable land in recent months, have vacant lots that may soon reach limits to their value.

This article uses an example based on a financial model to show how undeveloped lots can be priced out of the market, then discusses other risks to further increases in value and factors for owners to consider in continuing to hold vacant land. This article is provided for information and education only and is not intended as a solicitation of other broker’s listings.

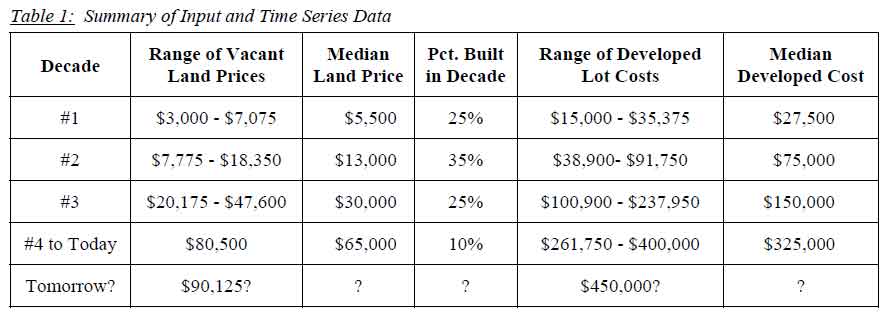

Example: To illustrate how vacant lots can be priced out of the market, take the hypothetical case of a subdivision begun in the late 1960s that has grown slowly. Table 1 illustrates the median prices of lots in each decade, the extent of building in each period, and the median cost of homes built in each decade. (Details on the model used to create this example are available from the author upon request.)

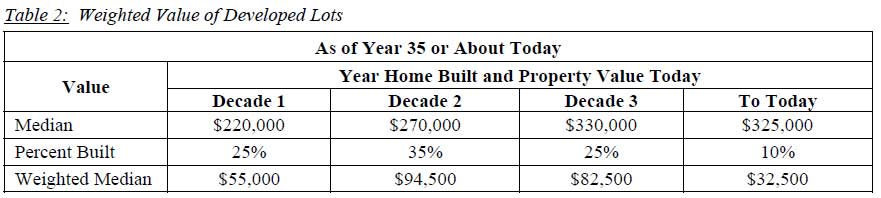

Table 2 illustrates the median value of developed property in the subdivision weighted by the portion that was built in each decade and its appreciated value to today. This appreciation assumes that homes in all age groups have been well kept and reasonably modernized over the years.

At some point, perhaps soon, buyers will answer, “No!” and then vacant lots have been priced out of the market. Given the scarcity of buildable lots today, it is unusual for buyers to purchase lots to build homes of lesser value in proportion to the land cost than assumed here. However, when such “down market development” does occur, the weighted value of the neighborhood is driven down as well further limiting the value of remaining vacant lots. Soft real estate markets can also cause lesser homes to spring up if lot owners are forced to sell at distressed prices by other financial factors.

Some lot owners’ answer to being priced out of the market is, “But I am going to build!” If that is your answer, recognize that regardless of what you originally paid for the lot you are, in effect, buying your lot at today’s value when you build on it. Building a lesser home may satisfy your needs, but it will cost you in the end and may hold down overall values. So, consider your alternatives.

If you have held the lot for some time, you probably have a large capital gain. While gains are typically taxed at federal rates of 20% or less, take a look at a tax-deferred exchange under Section 1031 of the Internal Revenue Code. (For more details go to www.apiexchange.com or contact the author). It may make sense to use an exchange to roll the gain over tax-free into another property better positioned in terms of its potential for appreciation rather than trying to build on your lot.

As the upside of holding a vacant lot becomes limited, keep in mind the risks of continuing to hold it. Risks include higher property taxes that increase your cost of ownership, more stringent development rules that increase your cost of building, and possible changes in real estate market conditions.

There are some exceptions to the illustration above. Where vacant land is appreciating very rapidly, the economics may justify redeveloping certain lots that have already been built on. This is the “teardown” phenomenon seen on waterfront parcels, but it is not common in other types of property.

The above case is for illustration purposes only. Your situation should be examined in a Comparative Market Analysis using this model tailored to your subdivision. To obtain a free Comparative Market Analysis based on this model and backed by facts, data and analysis please contact the author directly. Questions or comments? Please call the author.

About the Author: Chuck Braxton is a REALTOR® with the Meredith office of Roche Realty Group, Inc. He has applied his 25+ years of experience as a business executive to the challenges facing owners and buyers of real estate in the Lakes Region. Mr. Braxton has authored several articles and financial models on valuation for project development and real estate applications. In addition to this article, current works include: The Tax-Deferred Exchange: Is It Right for You?; What Is That View Worth?; and a series on values of waterfront, water access, and vintage properties in the Lakes & Mountains Region of New Hampshire. His website is at ww.ChuckBraxton.com. Mr. Braxton may be reached at his direct line: 603.677.2154, by email: [email protected] or toll free any time of day or evening at 800/926.5253, extension 342.